Investment clubs on Fractional let you operate efficiently as a collective. Skip the cost and red tape of syndications or funds. Pool resources with your friends, network, or audience. No middlemen. No legal headaches.

Just streamlined collaboration with your circle of believers.

Our process helps you execute faster together and without the overhead of traditional markets

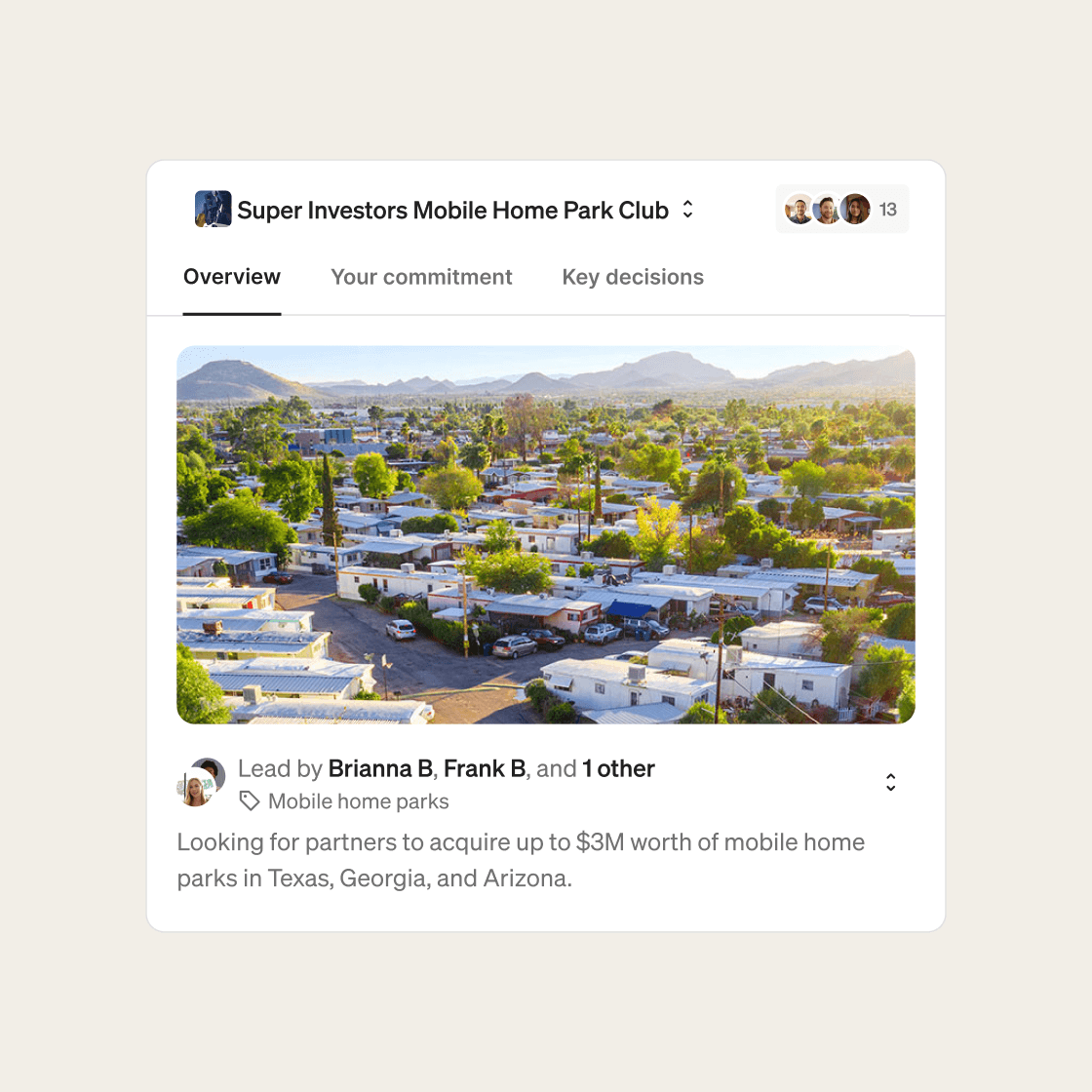

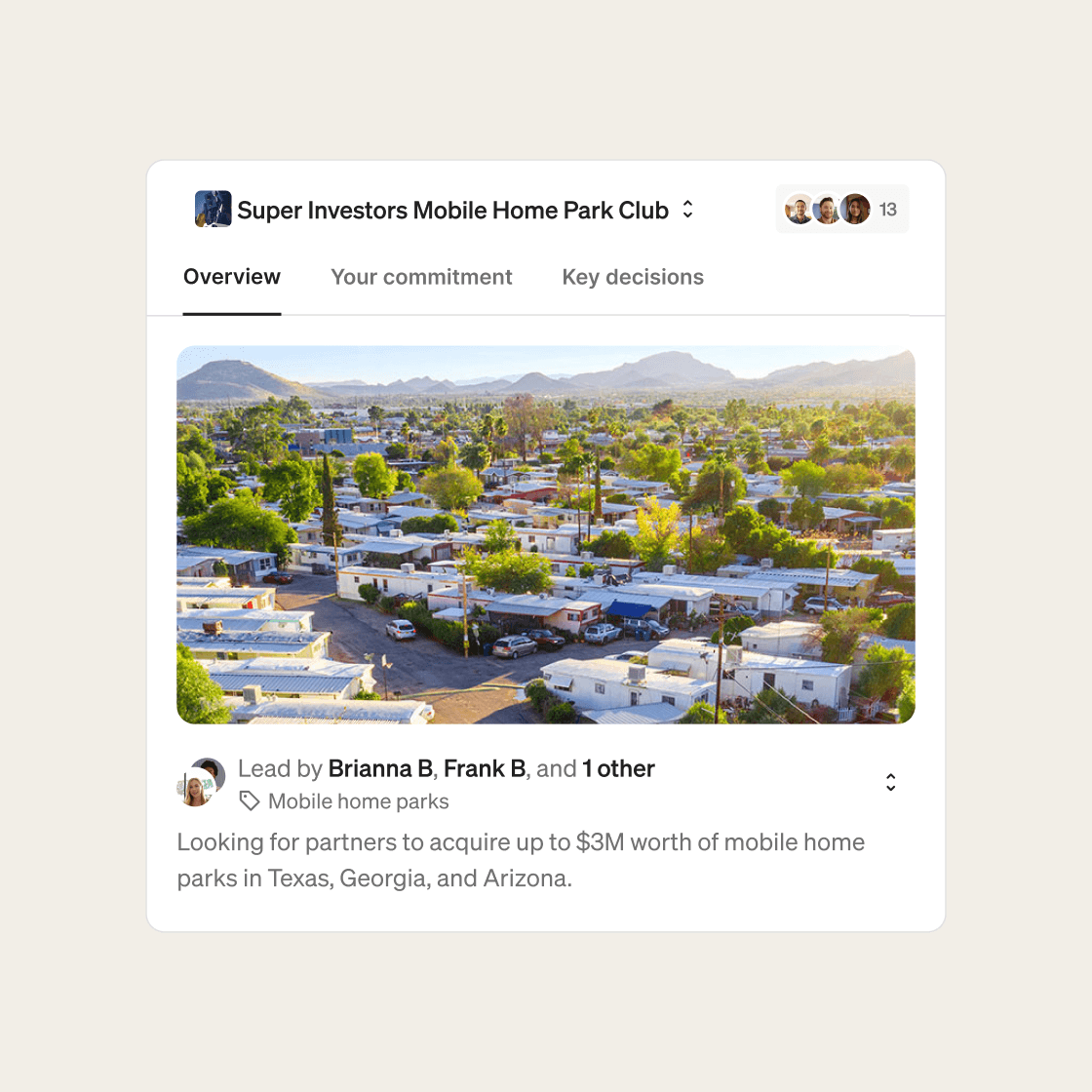

Outline your goals and niche. e.g. $1M for RV parks in Texas at 15%+ CoC

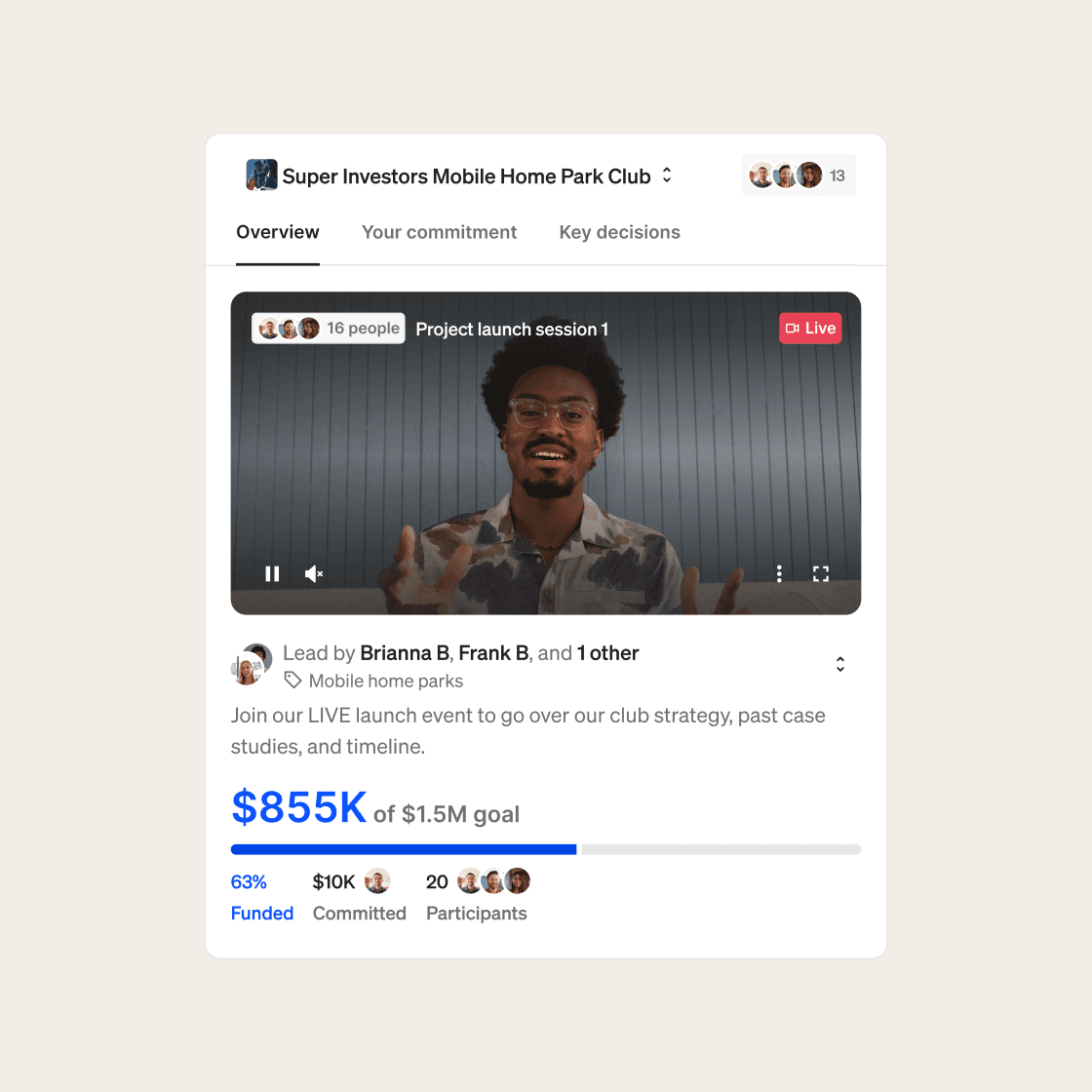

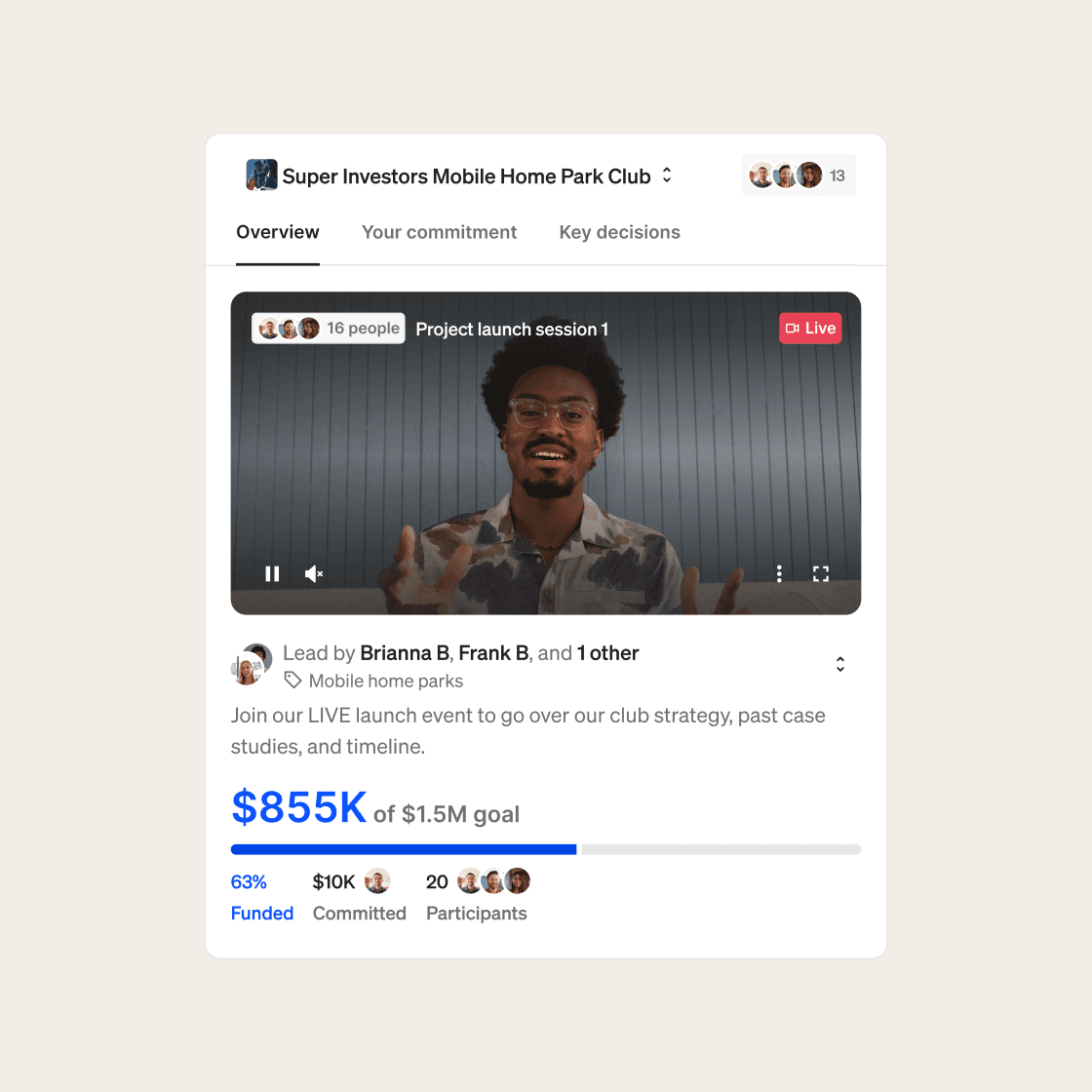

Share with your community and bring members on board.

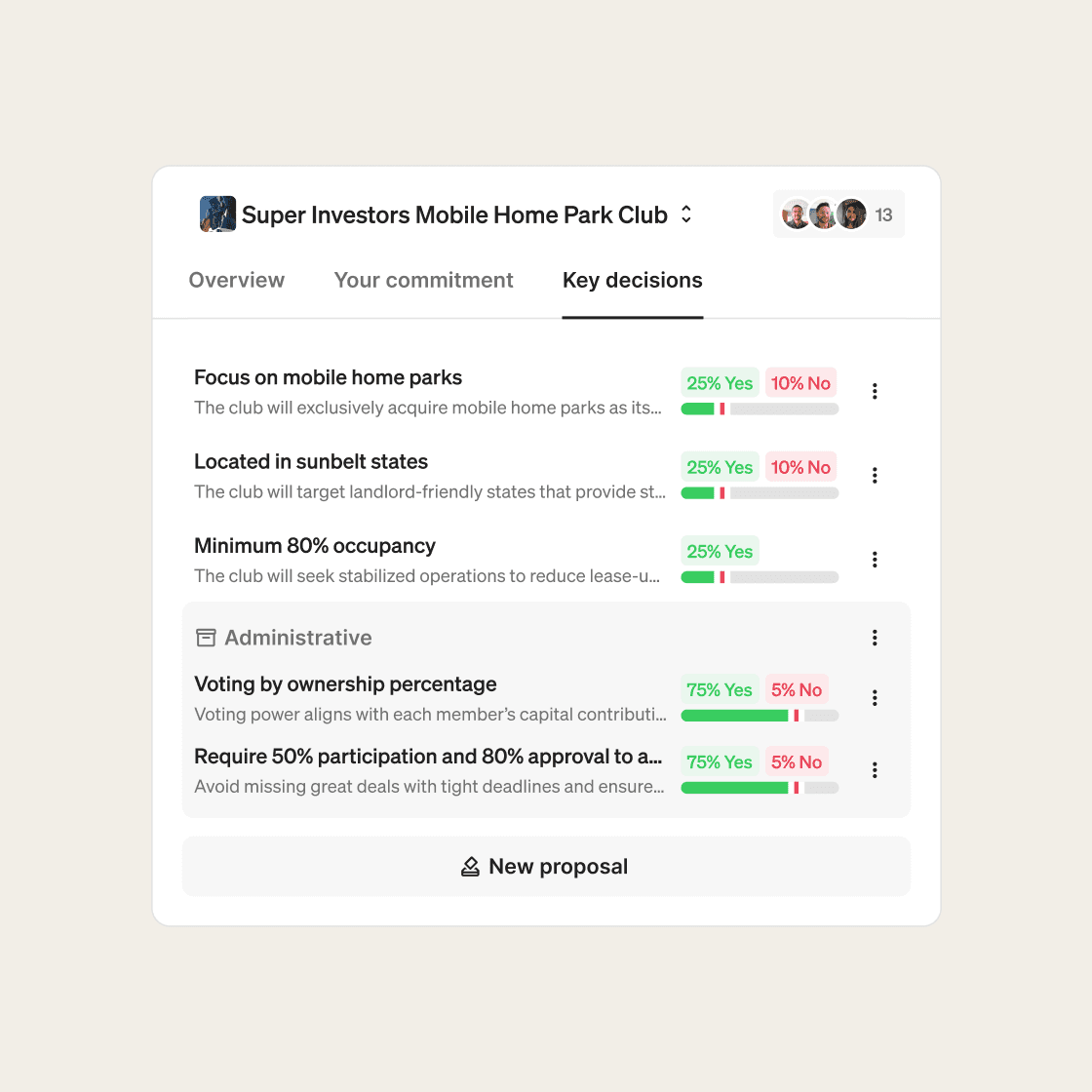

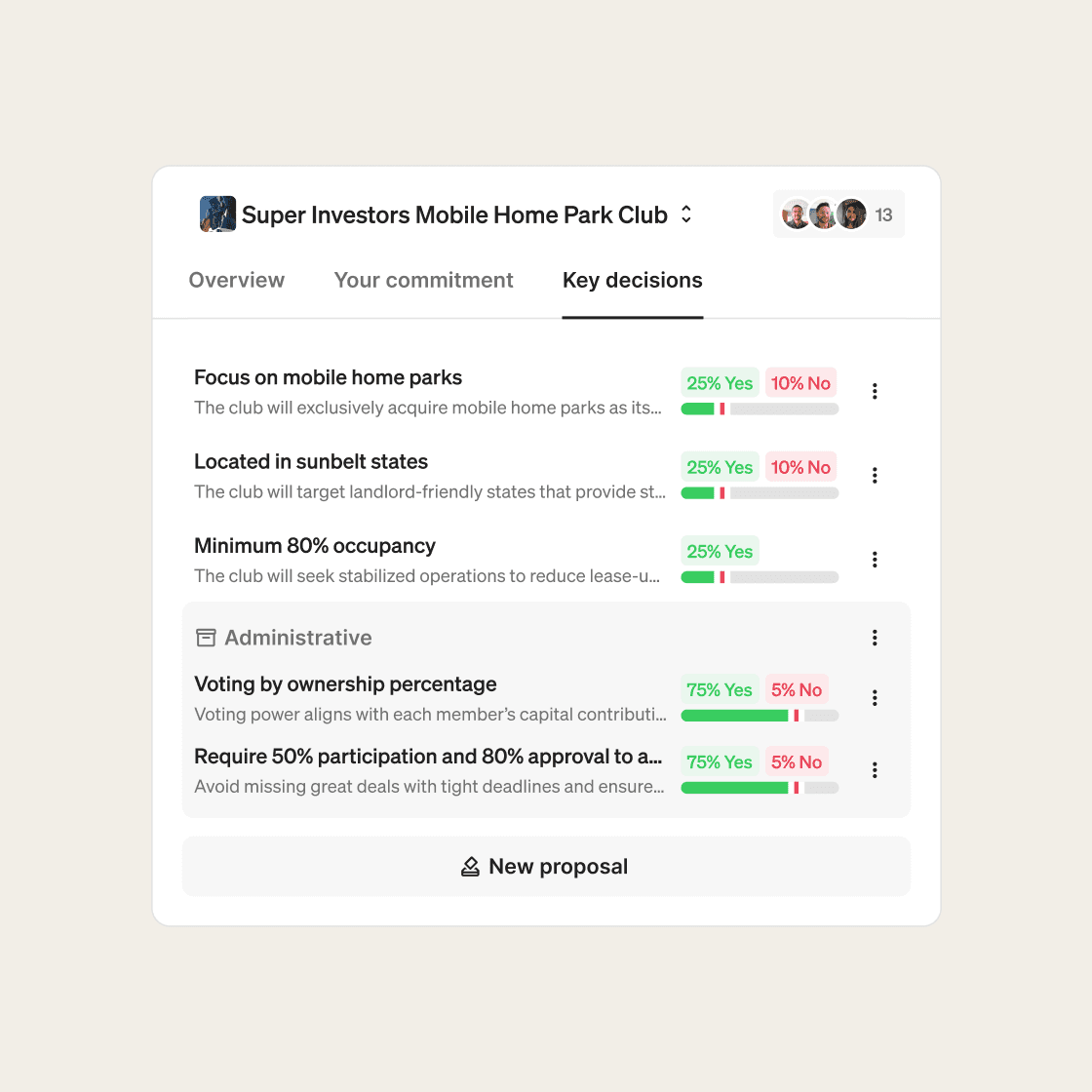

Pool your capital and vote with your members on the fundamentals.

Source and vet opportunities, and close the deal — we'll take care of the details.

Outline your goals and niche. e.g. $1M for RV parks in Texas at 15%+ CoC

Share with your community and bring members on board.

Pool your capital and vote with your members on the fundamentals.

Source and vet opportunities, and close the deal — we'll take care of the details.

With thousands of successful cases behind us, we've heard it all — but if not, we'll be ready with an answer.

What do you handle?

What do you handle?

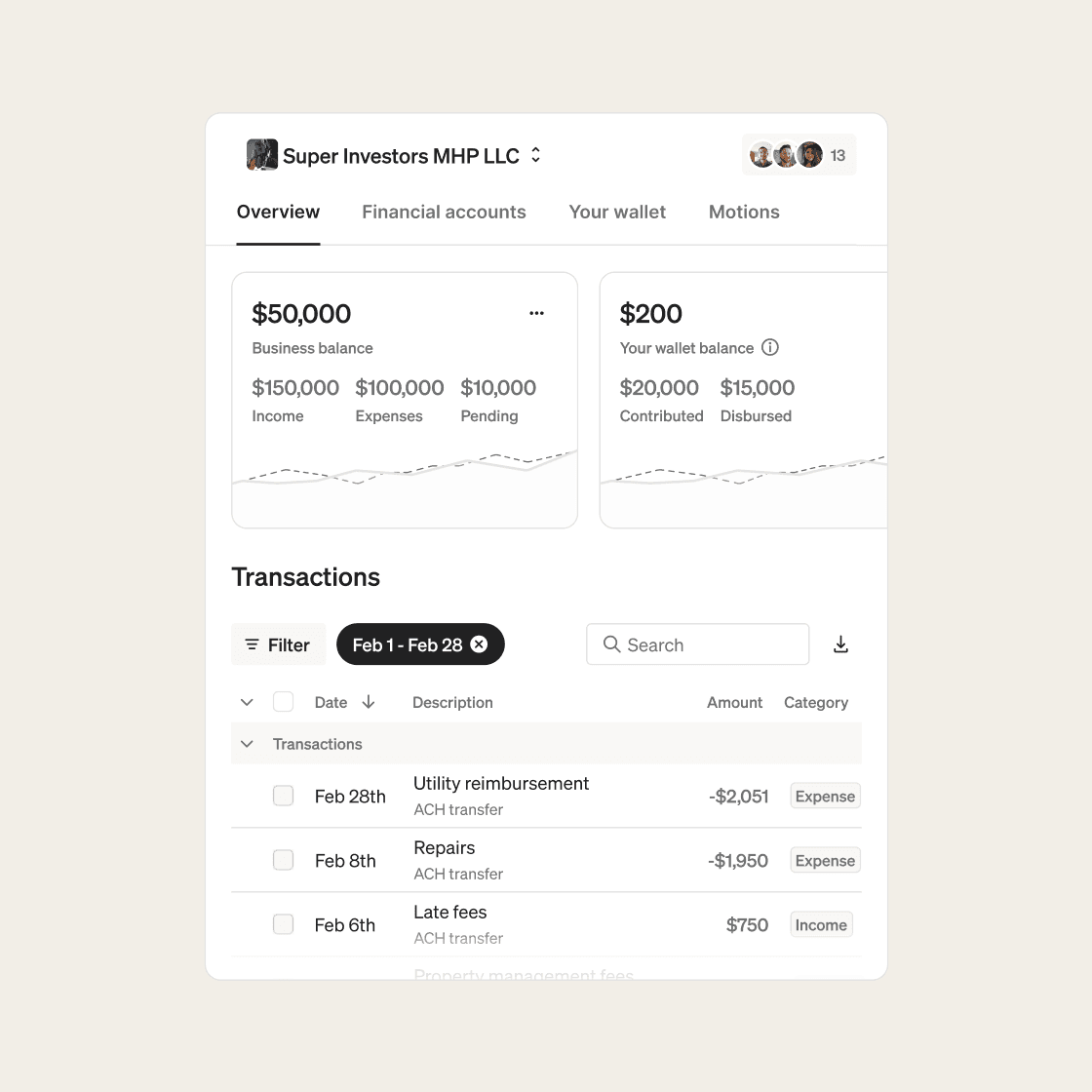

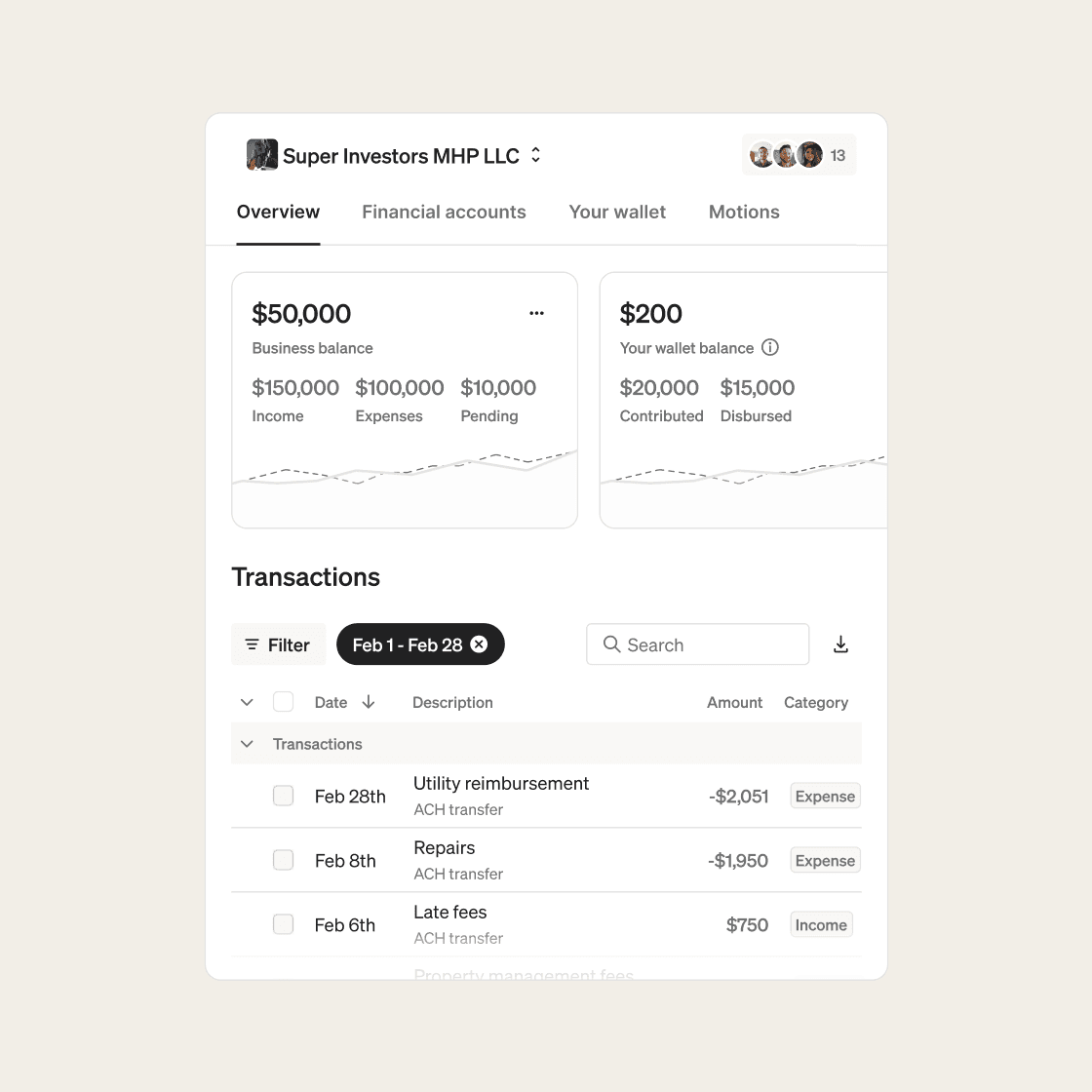

We manage your entire back office so you can focus on growing your business. From LLC compliance and bookkeeping to handling distributions, tax filings, and K-1s, we take care of the details that keep everything running smoothly. Whether it's routine paperwork or complex financial reporting, our team ensures nothing falls through the cracks.

Do I need to bring my own network?

Do I need to bring my own network?

Yes! The key to succeeding in a Fractional club comes down to your relationship with other club members. We typically have operators start with their own audience, and don't be afraid to get a plan started and reach out for interest.

What asset classes and strategies do you support?

What asset classes and strategies do you support?

Fractional clubs are asset and strategy agnostic — if you can do it by yourself so can your club. While real estate and private lending are the most common on our platform, we've also seen operators successfully pool capital for everything from country clubs to candy stores to laundromats.

If you've got a network of people excited to partner with you, we're here to help your group unlock its collective power.

How does this compare to a fund or syndication?

How does this compare to a fund or syndication?

Fractional investment clubs are fundamentally different from funds and syndications because they aren't structured as securities offerings. Instead of one operator raising from passive investors, every member of the club is an active participant with voting rights and shared decision-making power.

That means no expensive PPMs, 506(b)/(c) filings, or accredited-only restrictions. We're here to create a faster and more collaborative way for you to build an empire with your people.

Would I end up with “too many cooks in the kitchen”?

Would I end up with “too many cooks in the kitchen”?

Fractional makes voting and reaching a consensus as easy as making a decision yourself. Most clubs finalize important votes within a day.

Once the group makes a decision, the club leaders carry it out, ensuring the club's vision turns into action.

How much does Fractional cost?

How much does Fractional cost?

Fractional clubs are free to set up and launch.

When committing, investors pay a 3% transaction fee that covers the LLC formation, legal, compliance, and payment processing costs. For ongoing back-office services like profit distributions, tax filings, and K-1s, we charge $3,500 annually per club.

This keeps costs simple, transparent, and aligned with your wins.

A model proven to multiply the success of capital raisers turned club operators. Built alongside former SEC senior counsel.